How Long Keep Tax Records Self Employed . Notice of assessment) or need to submit your income declaration. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. You must keep your records for at least 5 years after the 31 january submission deadline of the. You have to keep your records for at least five years from 31 january following the tax year that the tax return. Keep all records of employment taxes for at least four years. Web how long should i keep employment tax records? Web how long to keep your records. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later.

from db-excel.com

You have to keep your records for at least five years from 31 january following the tax year that the tax return. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. Web how long should i keep employment tax records? Web how long to keep your records. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. You must keep your records for at least 5 years after the 31 january submission deadline of the. Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. Keep all records of employment taxes for at least four years. Notice of assessment) or need to submit your income declaration.

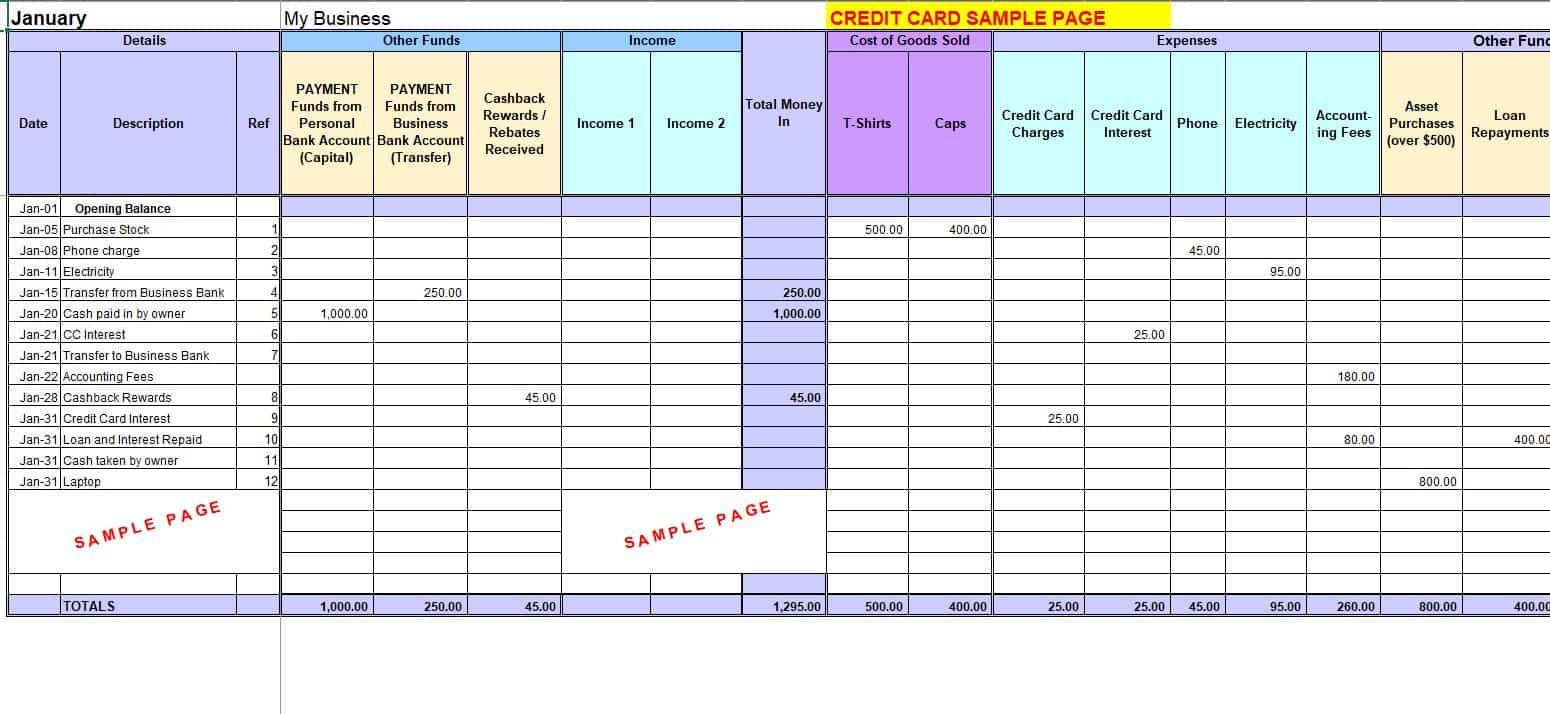

Self Employed Record Keeping Spreadsheet Spreadsheet Downloa free

How Long Keep Tax Records Self Employed Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. You must keep your records for at least 5 years after the 31 january submission deadline of the. Web how long should i keep employment tax records? Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. Notice of assessment) or need to submit your income declaration. Keep all records of employment taxes for at least four years. You have to keep your records for at least five years from 31 january following the tax year that the tax return. Web how long to keep your records.

From blog.eztax.in

Why & How long to keep your Tax Records How Long Keep Tax Records Self Employed You must keep your records for at least 5 years after the 31 january submission deadline of the. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. Web keep employment tax records for at least 4 years after the date that the tax becomes due. How Long Keep Tax Records Self Employed.

From mungfali.com

1099 Expense Tracker Excel Template How Long Keep Tax Records Self Employed Web how long should i keep employment tax records? You must keep your records for at least 5 years after the 31 january submission deadline of the. Keep all records of employment taxes for at least four years. Notice of assessment) or need to submit your income declaration. Web keep employment tax records for at least 4 years after the. How Long Keep Tax Records Self Employed.

From www.youtube.com

What Records Do I Need To Keep For My SelfEmployed Business YouTube How Long Keep Tax Records Self Employed Web how long should i keep employment tax records? Keep all records of employment taxes for at least four years. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. You must keep your records for at least 5 years after the 31 january submission deadline of the. Web how long to. How Long Keep Tax Records Self Employed.

From theinsiderr.com

How Long Keep Tax Records? How Long Keep Tax Records Self Employed You must keep your records for at least 5 years after the 31 january submission deadline of the. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. You have to keep your records for at least five years from 31 january following the tax year. How Long Keep Tax Records Self Employed.

From www.youtube.com

The BUSINESS SPREADSHEET TEMPLATE for SelfEmployed Accounting & Taxes How Long Keep Tax Records Self Employed Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. You have to keep your records for at least five years from 31 january following the tax year that the tax return. Notice of assessment) or need to submit your income declaration. Web the irs recommends. How Long Keep Tax Records Self Employed.

From wellkeptclutter.com

Cleaning Business Taxes Resources for House Cleaning Business How Long Keep Tax Records Self Employed Keep all records of employment taxes for at least four years. Web how long to keep your records. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. Web how long should i keep employment tax records? Web keep employment tax records for at least 4. How Long Keep Tax Records Self Employed.

From professionalsampletemplate.blogspot.com

Record Keeping Template For Small Business Professional Sample Template How Long Keep Tax Records Self Employed Keep all records of employment taxes for at least four years. Web how long should i keep employment tax records? Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web how long to keep your records. Web the irs recommends keeping returns and other tax documents for three years—or two years. How Long Keep Tax Records Self Employed.

From db-excel.com

Self Employed Record Keeping Spreadsheet In Self Employed Bookkeeping How Long Keep Tax Records Self Employed Notice of assessment) or need to submit your income declaration. Web how long should i keep employment tax records? Web how long to keep your records. Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. You must keep your records for at least 5 years. How Long Keep Tax Records Self Employed.

From theadvisermagazine.com

How to Keep Good Tax Records How Long Keep Tax Records Self Employed Keep all records of employment taxes for at least four years. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. You. How Long Keep Tax Records Self Employed.

From aseanup.com

Financial Planning for the SelfEmployed Tips to Ensure LongTerm How Long Keep Tax Records Self Employed Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. You have to keep your records for at least five years from 31 january following the tax year that the tax return. Web the irs recommends keeping returns and other tax documents for three years—or two. How Long Keep Tax Records Self Employed.

From www.freshbooks.com

Tax Records How Long Do You Have to Keep Them? Freshbooks How Long Keep Tax Records Self Employed Web how long should i keep employment tax records? Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. Web how long to keep your records. You must keep your records for at least 5 years after the 31 january submission deadline of the. Notice of. How Long Keep Tax Records Self Employed.

From db-excel.com

Self Employed Record Keeping Spreadsheet within Selfemployed Expenses How Long Keep Tax Records Self Employed Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. You must keep your records for at least 5 years after the 31 january submission deadline of the. Web how long to keep your records. Keep all records of employment taxes for at least four years.. How Long Keep Tax Records Self Employed.

From db-excel.com

Self Employed Expenses Spreadsheet Profit And Loss Statement with Self How Long Keep Tax Records Self Employed Web how long should i keep employment tax records? Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. Notice of assessment) or need to submit your income declaration. You must keep your records for at least 5 years after the 31 january submission deadline of. How Long Keep Tax Records Self Employed.

From blog.sprintax.com

What Nonresidents Should Do After 2024 Tax Season Ends How Long Keep Tax Records Self Employed Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. Web how long should i keep employment tax records? You have to keep your records for at least five years from 31 january following the tax year that the tax return. You must keep your records. How Long Keep Tax Records Self Employed.

From www.taxslayer.com

Essential RecordKeeping Tips for SelfEmployed Workers How Long Keep Tax Records Self Employed You must keep your records for at least 5 years after the 31 january submission deadline of the. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later.. How Long Keep Tax Records Self Employed.

From drivenownetwork.com

I am selfemployed. What should I keep track of? Drive Now Network How Long Keep Tax Records Self Employed Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. Keep all records of employment taxes for at least four years. Web keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later. Web. How Long Keep Tax Records Self Employed.

From brandongaille.com

How Long to Keep Tax Records and Other Statements How Long Keep Tax Records Self Employed Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is later. You have to keep your records for at least five years from 31 january following the tax year that the tax return. Keep all records of employment taxes for at least four years. Web how long. How Long Keep Tax Records Self Employed.

From www.hss-ca.com

How Long Do I Have to Keep My Business Tax Records? Hogg, Shain & Scheck How Long Keep Tax Records Self Employed Notice of assessment) or need to submit your income declaration. Web how long should i keep employment tax records? Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax, whichever is. How Long Keep Tax Records Self Employed.